Accounting, Business & Tax Strategy for Business

Proactive tax-planning to limit what you owe

Best-practices to streamline your business

Fewer back-office tasks, more time for you

Taxes are a huge burden on small businesses, and many owners pay more than they should because they don’t have complete data or up-to-date books, and their tax pro isn’t helping them plan proactively.

The good news is, we can help.

1

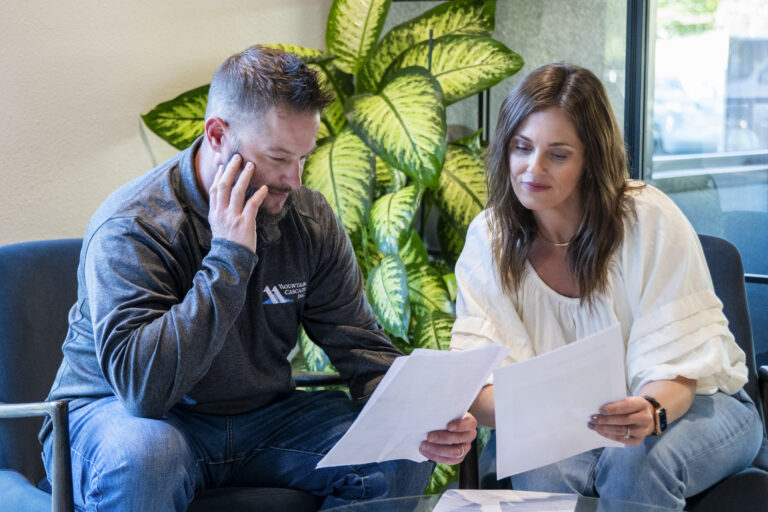

We start with a no-pressure discovery call to understand your business goals, diagnose any challenges you’re facing, and see if we can identify any immediate tax savings.

2

Next, you enter into our 90-day onboarding program. We begin implementing your initial strategy, get your books and taxes caught up, and train you to work within our proven tax and accounting system.

3

Finally, we settle into the ongoing work of monthly bookkeeping, year-round tax consulting, and proactive planning, so you can build a better business and reap the benefits of your hard work.

Your tax strategy is just as important as your overall financial strategy. How much of your hard earned money you get to keep is directly correlated with the amount of foresight and creativity put into the process. Our advisors go beyond planning to strategize on how to save you the most tax over the long-term. We hold special credentials as Certified Tax Coaches to ensure we are at the top of our game for our business owners, and we regularly hear from our clients that the level of planning they get from us is like nothing they have ever seen.

You don’t trust your tax preparation to just anyone. You want an established team that is well trained in preparation, as well as planning and strategizing for your future. Spotting the savings opportunities is so important, but so is implementing and tracking those savings to ensure the plan is working and to maintain the plan on an ongoing basis, to accommodate the changing needs of your growing business. We focus on tax preparation and strategies for business owners and our process ensures that no stone is left unturned when it comes to lowering your taxes.

Your financial plan is only as good as the data used to create it. You didn’t get into business to be a bookkeeper or an accountant. We get that. Whether your books need a little bit of help or a lot of help, we are equipped to oversee your accounting with regular check-ins with your in-house bookkeeper to fine-tune your financial statements and training to use the latest technology for maximum efficiency and accuracy. Many business owners find that they enjoy trusting their entire accounting department to us, and prefer not to have an in-house bookkeeper. During your initial review, we will advise you of your options and our recommendation, and you make the choice.

Our team manages your complete financial record-keeping. We maintain your general ledger, and ensure all transactions are properly categorized and recorded. By tracking your invoices, bills, and payments, we keep your financial records accurate and up-to-date. We also prepare regular financial statements, giving you a clear picture of your business’s performance. Our bookkeepers coordinate with your staff to gather necessary documentation and address any accounting questions that arise during normal business operations. This thorough approach to bookkeeping provides you with reliable financial data for tax preparation, business planning, and important management decisions, while freeing up your time to focus on running your business.

Your business is a living, breathing organism. It grows and morphs over time and your needs change. You need a team behind you that understands that, has seen businesses in different stages and works to anticipate your needs before you do. You want to be confident that you have prepared well for the future by projecting your cash flows and financial trends and understanding the drivers of your income and expenses. Our team will discuss with you where you are, where you have come, and where you want to be. We will benchmark you against your industry to give you a scorecard to see how you line up and discuss specific objectives for improvement. We have discovered that this approach helps business owners launch their business higher, faster, and stronger with the confidence of our great team behind them.

About J.R. Martin CPA