Opportunity zones in California offer tax breaks and other incentives to encourage investment and development. Learn more about how they can help you.

In an effort to encourage economic growth and job creation in distressed areas, Congress continues to offer tax incentives to investors who invest in designated specific areas in the country known as Qualified Opportunity Zones (QOZ). Along with over 800 designated areas in California, both Shasta and Trinity County are QOZs.

What Are The Opportunity Zones In California?

Opportunity Zones in California are designated by the governor of California, in consultation with the state’s Department of Housing and Community Development. The governor selects census tracts for Opportunity Zone designation based on criteria such as poverty rate, median family income, and unemployment rate. The governor then submits the selected tracts to the U.S. Department of Treasury for certification. Once certified, the tracts are officially designated as Opportunity Zones and are eligible for certain tax benefits under the federal Opportunity Zone program.

Opportunity Zones In California Counties

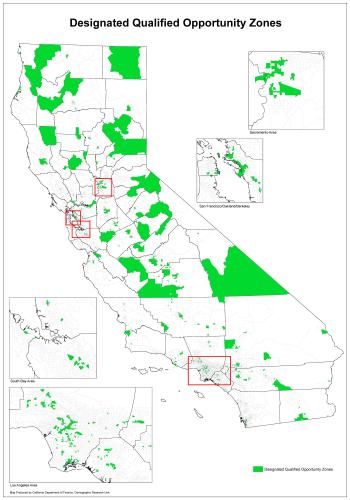

There are many counties that have been designated as Opportunity Zones throughout the state of California. To see a list and a map of California Counties that qualify as Opportunity Zones in California, click HERE.

Tax Advantages From Investing In Opportunity Zones

One of the main tax advantages of investing in an Opportunity Zone is the ability to defer paying taxes on capital gains. If an investor reinvests capital gains into an Opportunity Zone within 180 days, they can defer paying taxes on those gains until the earlier of two dates: the date the Opportunity Zone investment is sold or December 31, 2026.

Additionally, if the Opportunity Zone investment is held for at least five years, the investor can receive a 10% reduction in the amount of deferred capital gains taxes. And if held for at least seven years, an investor can receive a 15% reduction. Furthermore, if the investment is held for at least 10 years, any appreciation on the Opportunity Zone investment is permanently excluded from taxation.

Another advantage of investing in an Opportunity Zone is the potential for a higher rate of return, as investment in these areas can lead to community revitalization and economic development.

Investors Can Benefit From Opportunity Funds

Opportunity Funds are investment vehicles created to invest in Opportunity Zones, which are designated low-income communities eligible for certain tax benefits under the federal Opportunity Zone program. Investing in Qualified Opportunity Zones in California can be done through a Qualified Opportunity Fund (QOF), which is a special type of investment vehicle that is used to invest in Opportunity Zones. QOFs can be set up as a partnership or corporation and must hold at least 90% of their assets in Opportunity Zone property, such as real estate or a business operating within an Opportunity Zone.

Take Advantage Of The Tax Credits For Opportunity Zone Investors In California

Investors can benefit from Opportunity Funds in several ways:

- Tax Deferral: Investors can defer paying taxes on capital gains by investing in an Opportunity Fund within 180 days of realizing the gains.

- Tax Reduction: Investors can reduce the amount of taxes they owe on their capital gains by investing in an Opportunity Fund. The longer the investment is held, the greater the tax reduction.

- Tax Exclusion: Investors can potentially exclude from taxes the appreciation on their Opportunity Fund investment if the investment is held for at least 10 years.

- Potential for High Returns: Opportunity Funds invest in real estate and business ventures in Opportunity Zones, which have the potential for high returns.

- Community Impact: Opportunity Funds provide capital for development and business growth in low-income communities which can bring economic growth, job creation and other positive impacts to the community.

It’s important to note that the tax benefits of Opportunity Funds are complex and investors should consult a tax professional before investing. Additionally, Opportunity Funds are subject to the same risks as any other investment, so investors should carefully review the fund’s offering documents and consult a financial advisor to ensure that the investment is suitable for their risk tolerance and financial situation. A CPA can assist investors in identifying potential investments and can help ensure that the investment meets the requirements for tax benefits.

Planning to invest in opportunity zones? Read our financial FAQs to get more guidance.